Friendship Contract Pdf

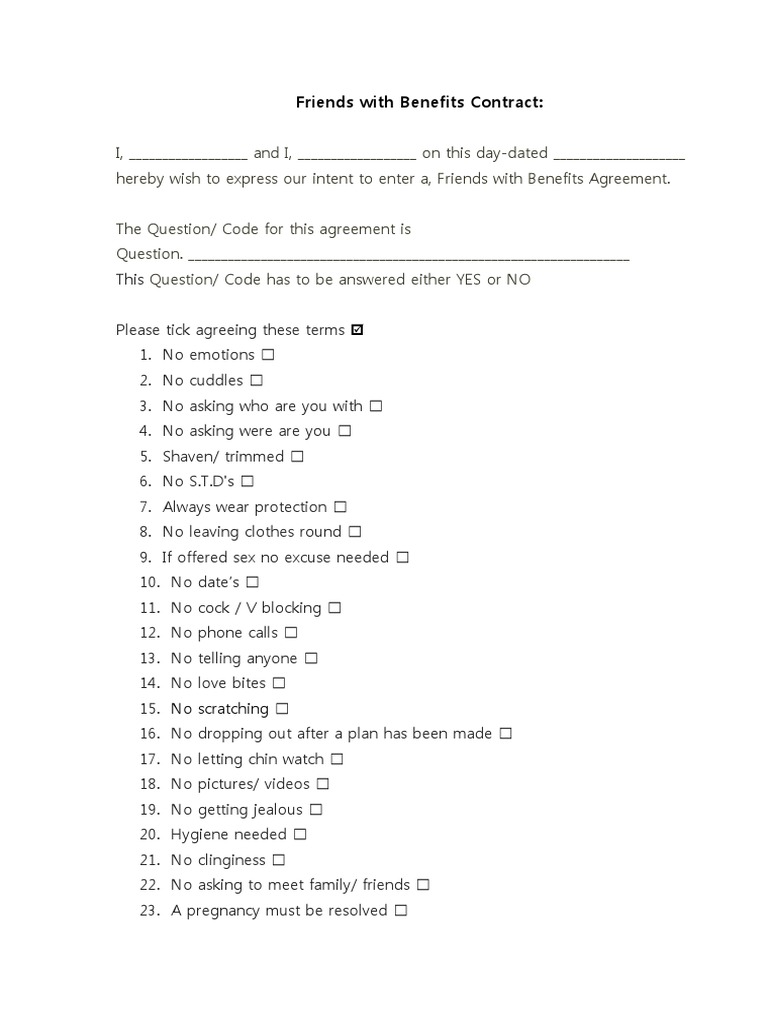

This Contract Is the Only Way to Make Sure Your Friends Actually Like You. Sign on the dotted line, so I know it's real. FRIENDSHIP CONTRACT. BE IT KNOWN, this agreement is entered into on. (Don’t worry if you’re not sure where to start with your contract, much more detail is on its way.) The Benefits Of Having A Relationship Contract. I have had dozens of my partnered/married clients write up relationship contracts with each other and the benefits in their relationship (and my own, personally) have been far-reaching. Read story The official Best friend contract by snickers1999 with 8,955 reads. Friend, best, contract. 1) I promise not fall in love with your best friend 2) I.

- How To Write A Friendship Contract

- Friendship Contract Pdf Free

- Friendship Contract Pdf Online

- Free Sample Friendship Contracts

- Friendship Contract Pdf Download

A loan agreement is a written agreement between a lender and borrower. The borrower promises to pay back the loan in line with a repayment schedule (regular payments or a lump sum). As a lender, this document is very useful as it legally enforces the borrower to repay the loan. This loan agreement can be used for business, personal, real estate, and student loans.

Family Loan Agreement – For the borrowing of money from one family member to another.

I Owe You (IOU) – The acceptance and confirmation of money that has been borrowed from one (1) party to another. Does not commonly give details about how or when money will be paid back or list any interest rate, payment penalties, etc.

Loan (Personal) Guarantee – If someone does not have sufficient credit to borrow money this form allows someone else to be liable as well if the debt is not paid.

Personal Loan Agreement – For most loans from individual to individual.

Release of Debt – After a note has been paid-in-full this document should be issued as proof that the borrower has satisfied their debt.

Release of Personal Guarantee – Frees the Guarantor from responsibility and is no longer liable.

Secured Promissory Note – Loan agreement that lists assets that are to be handed to the lender if the payment is not made in accordance with the form.

Unsecured Promissory Note – Similar to a standard loan agreement, a document that lists a promise to pay with dates, interest rate, and penalties (if any).

A loan agreement can come in many variations and the purpose for a loan are a many. An individual or business can use a loan agreement to set out terms such as an amortization table detailing interest (if any) or by detailing the monthly payment on a loan. The greatest aspect of a loan is that it can be customized as you see fit by being highly detailed or just a simple note. No matter the case, any loan agreement must be signed, in writing, by both parties.

Lending Money to Family & Friends – When talking about loans, most relate loans to banks, credit unions, mortgages and financial aid but hardly do people consider obtaining a loan agreement for friends and family because they are just that – friends and family. Why would I need a loan agreement for people I trust the most? A loan agreement is not a sign that you don’t trust someone, it is simply a document you should always have in writing when loaning money just like having your driver’s license with you whenever you drive a car. The people who give you a hard time about wanting a loan in writing are the same people you should be worried about the most – always have a loan agreement when lending money.

Step 1 – Choose a Loan Type

- Business Loan – For expansion or new equipment. If the business is new or in bad financial shape a personal guarantee by the owner of the entity may be required by the lender.

- Car Loan – Used to purchase a vehicle usually with a term of 5 years (60 months).

- FHA Loan – To purchase a home with bad credit (cannot be below 580). Requires the borrower to purchase insurance in the chance of default.

- Home Equity Loan – Secured by the borrower’s home in case the funds are not paid-back.

- PayDay Loan – Also known as a “cash advance”, requires the borrower to show their most recent pay-stub and write a check from the bank account where they are paid from their employer.

- Personal Loan – Between friends or family.

- Student Loan – Provided by the federal government or privately in order to pay for academic studies at a college or university.

Step 2 – Obtain/Provide Your Credit Score

The first step into obtaining a loan is to run a credit check on yourself which can be purchased for $30 from either TransUnion, Equifax, or Experian. A credit score ranges from 330 to 830 with the higher the number representing a lesser risk to the lender in addition to a better interest rate that may be obtained by the borrower. In 2016, the average credit score in the United States was 687 (source).

Download the game2. RFactor Free DownloadrFactor is one of the best racing simulator games.Here are the download links.1. Rfactor crack exe.

Once you have obtained your full credit history you may now use it to entice prospective lenders in an effort to receive funds.

Step 3 – Secured or Unsecured

How To Write A Friendship Contract

Depending on the credit score the lender may ask if collateral is needed to approve the loan.

Secured Loan – For individuals with lower credit scores, usually less than 700. The term ‘secured’ means the borrower must put up collateral, such as a home or a car, in case the loan is not repaid. Therefore, the lender is guaranteed to obtain an asset of the borrower in the event they are paid-back.

Unsecured Loan – For individuals with higher credit scores, 700 and above. Does not require the borrower to provide collateral.

Step 4 – Sign the Agreement

Depending on the loan that was selected a legal contract will need to be drafted stating the terms of the loan agreement including:

- Borrowed amount;

- Interest rate;

- Repayment period;

- Late fee(s);

- Default language;

- Pre-payment penalty (if any)

Depending on the amount of money that is borrowed the lender may decide to have the agreement authorized in the presence of a notary public. This is recommended if the total amount, principal plus interest, is more than the maximum acceptable rate for the small claims court in the jurisdiction of the parties (usually $5,000 or $10,000).

Step 5 – Borrower Receives Money

After the agreement has been authorized the lender should disburse the funds to the borrower. The borrower will be held in accordance with the signed agreement with any penalties or judgments to be ruled against them if the funds are not paid back in full.

Most online services offering loans usually offer quick cash type loans such as Pay Day Loans, Installment Loans, Line of Credit Loans and Title Loans. Loans such as these should be avoided as Lenders will charge maximum rates, as the APR (Annual Percentage Rate) can easily go over 200%. It’s very unlikely that you will obtain an adequate mortgage for a house or a business loan online.

If you do decide to take out a personal loan online, make sure you do so with a qualified-well known bank as you can often find competitive low-interest rates. The application process will take longer as more information is needed such as your employment and income information. Banks may even want to see your tax returns.

Acceleration – A clause within a loan agreement that protects the lender by requiring the borrower to pay off the loan (both the principal and any accumulated interest) immediately if certain conditions occur.

Borrower – The individual or company receiving money from the lender which will then have to pay back the money according to the terms in the loan agreement.

Collateral – An item of worth, such as a house, is used as insurance to protect the lender in the event the borrower is unable to pay back the loan.

Default – Should the borrower default due to their failure to pay, the interest rate shall continue to accrue according to the agreement, as set forth by the lender, on the balance of the loan until the loan is paid in full.

Interest (Usury) – The cost associated with borrowing the money.

Late-Payment – If the borrower anticipates that they may be late on their payment, they must contact and make arrangements with the lender. Additional late fees may apply.

Lender – The individual or company releasing funds to the borrower which will then be paid back to their principal, usually with interest, according to the terms set in the loan agreement.

Repayment Schedule – An outline detailing the loan’s principal and interest, the loan payments, when payments are due and the length of the loan.

How can I get personal loans for bad credit?

Friendship Contract Pdf Free

The lower your credit score is, the higher the APR (Hint: You want low APR) will be on a loan and this is typically true for online lenders and banks. You should have no problem obtaining a personal loan with bad credit as many online providers cater to this demographic, but it will be difficult to pay back the loan as you will be paying back double or triple the principal of the loan when it’s all said and done. Payday loans are a widely offered personal loan for people with bad credit as all you need to show is proof of employment. The lender will then give you an advance and your next paycheck will go to payoff the loan plus a big chunk of interest.

Subsidized loan vs Unsubsidized loan?

A Subsidized loan is for students going to school and its claim to fame is that it does not accrue interest while the student is in school. An Unsubsidized loan is not based on financial need and it can be used for both undergraduate and graduate students.

What is sharking?

An individual or organization practicing predatory lending by charging high-interest rates (Known as a “Loan Shark“). Each State has its own limits on interest rates (called the “Usury Rate”) and loan sharks illegally charge higher than the allowed maximum rate, although not all loan sharks practice illegally but instead deceitfully charge the highest interest rate legal under the law.

What does consolidate mean?

Put simply, to consolidate is to take out one sizable loan to payoff many other loans by having only one payment to make every month. This is a good idea if you can find a low-interest rate and you want simplicity in your life.

What is a parent plus loan?

A Parent Plus Loan, also known as a “Direct PLUS loan”, is a federal student loan obtained by the parent of a child needing financial help for school. The parent must have a healthy credit score in order to obtain this loan. It offers a fixed interest rate and flexible loan terms, however, this type of loan has a higher interest rate than a direct loan. Parents generally would only obtain this loan to minimize the amount of student debt on their child.

The following example shows how to write and complete our Free Loan Agreement Template. Follow the steps and enter your information accordingly.

Step 1 – Loan Amount, Borrower and Lender

The most important characteristic of any loan is the amount of money being borrowed, therefore the first thing you want to write on your document is the amount, which can be located on the first line. Follow by entering the name and address of the Borrower and next the Lender. In this example, the Borrower is located in the State of New York and he is asking to borrow $10,000 from the lender.

Step 2 – Payment

Not all loans are structured the same, some lenders prefer payments every week, every month, or some other type of preferred time schedule. Most loans typically use the monthly payment schedule, therefore in this example, the Borrower will be required to pay the Lender on the 1st of every month while the Total Amount shall be paid by January 1st, 2019 giving the borrower 2 years to pay off the loan.

Step 3 – Interest

The interest charged on a loan is regulated by the State in which it originates and it’s governed by the State’s Usury Rate Laws. Each State’s Usury Rate varies therefore it’s important to know the rate before charging the borrower an interest rate. In this example, our loan originates in the State of New York, which has a maximum Usury Rate of 16% which we will use.

Step 4 – Expenses

In the event that the Borrower defaults on the loan, the Borrower is responsible for all fees, including any attorney fees. No matter the case, the Borrower is still responsible for paying the principal and interest if a default occurs. Simply enter the State in which the loan originated.

Step 5 – Governing Law

The State in which your loan originates, meaning the State in which the Lender’s business operates or resides, is the State that will govern your loan. In this example, our loan originated in the State of New York.

Step 6 – Signing

A loan will not be legally binding without signatures from both the Borrower and Lender. For extra protection regarding both parties, it’s strongly recommended to have two witnesses sign and be present at the time of signing.

In the Netherlands, a friendship contract (‘vriendschapscontract’) is an agreement which regulates the consequences of a social relationship between two or more persons under family law as well as property law. Such a contract has no prescribed form. From an evidential point of view a written or notarial form is preferred. In addition, parties are in principle (see article 3:40 of the Dutch Civil Code (Burgerlijk Wetboek (BW)) free to determine the content of their agreement. For example, a tangible or intangible duty of care can be established, a power of attorney can be granted in case a party can no longer act on his own behalf, and an arrangement can be made for the event that one party obtains a good that, in whole or in part, is financed with assets of the other. In the Dutch law of persons and family law there are as of yet no legal effects attached to friendship contracts, which is also not expected to happen in the near future.[1] The friendship contract is therefore currently governed by the general Dutch contract and property law.

The first friendship contract[edit]

The first friendship contract was concluded in the Netherlands between best friends Joost Janmaat and Christiaan Fruneaux (who do not have a love affair together). The notarised contract was executed before civil-law notary Maarten Meijer on May 7, 2015.[2] This movement stems from the desire to introduce the institute of friendship into Dutch law. Janmaat and Fruneaux believe that friendship is playing an – increasingly – important role in society, which should also be legally recognized in certain areas of law. For example, they have in mind a lower inheritance tax rate for friends and the right not to testify against your best friend. The thought that the family is the only cornerstone of society is considered passé. Friends are, in practice, more and more on an equal par with family members and/or life partners.

Public reactions[edit]

- The chairman of the Dutch Humanist Association (Humanistisch Verbond), Boris van der Ham, also calls for the legal recognition of friendship in (and outside) the Netherlands in the members’ magazine HUMAN.[3] In his opinion the Dutch law does not reflect current reality on this issue.

- The foundation Centrum Individu en Samenleving (CISA)[4] sees the increasing number of persons living in different social arrangements than marriage as a reason to break the unilateral focus on marriage.[5]

See also[edit]

- Since July 1, 2015 an employee can take a short- or long-term paid care leave for the care of a social relationship (provided that the care directly ensues from this relationship and it is reasonable that the care is provided by the employee).[6]

- Member of Parliament Wouter Koolmees (D66) has proposed a motion to grant singles without children the opportunity to appoint one other social relation who can inherit at the reduced tax rate that applies to descendants in the second or further degree.[7]

Friendship Contract Pdf Online

See also[edit]

References[edit]

Free Sample Friendship Contracts

- ^The Dutch government recently decided to not even create a regulation for unmarried and unregistered cohabitants.

- ^See E. Verhagen & C. Mol, ‘Het vriendschapscontract’, in: W. Pintens & C. Declerck (red.), Patrimonium 2015, Brugge: Die Keure 2015 (forthcoming).

- ^'Human'(PDF). Humanistisschverbond.nl. 2015. Retrieved 2015-09-20.

- ^'Cisa'. cisasite.nl.

- ^See L. de Zwaan & K. van der Leer, De sociale familie: de maatschappelijke emancipatie van alleenstaanden, Den Haag: CISA 2013, p. 48.

- ^Article 5:1 para. 2, under g, Dutch Work and Care Act (Wet arbeid en zorg (WAZO)); Article 5:9 WAZO jo. article 5:1 para 2, under g, WAZO.

- ^See Kamerstukken II 2014/15, 34 000 IX, nr. 22 (Motie van het lid Koolmees).